The Biotech Resurrection: The Period of Biotech Outperformance Has Begun

It’s becoming increasingly clear that the US economy is entering a recession. We are seeing consumer confidence at multi-decade lows, home sales are slowing, major retailers such as Target and Walmart are cutting their sales outlook and stating that they are facing major inventory gluts throughout their businesses. The list goes on and on. It is clear that the deteriorating economic data is widespread and cuts deeply throughout key areas of the economy, including housing, retail, and travel.

As savvy investors, we must embrace the cyclical nature of the economy and financial markets. That often involves identifying which sectors of the stock market are likely to perform poorly in weakening economic environments, and which sectors are more likely to outperform during periods of consumer retrenchment and declining housing prices.

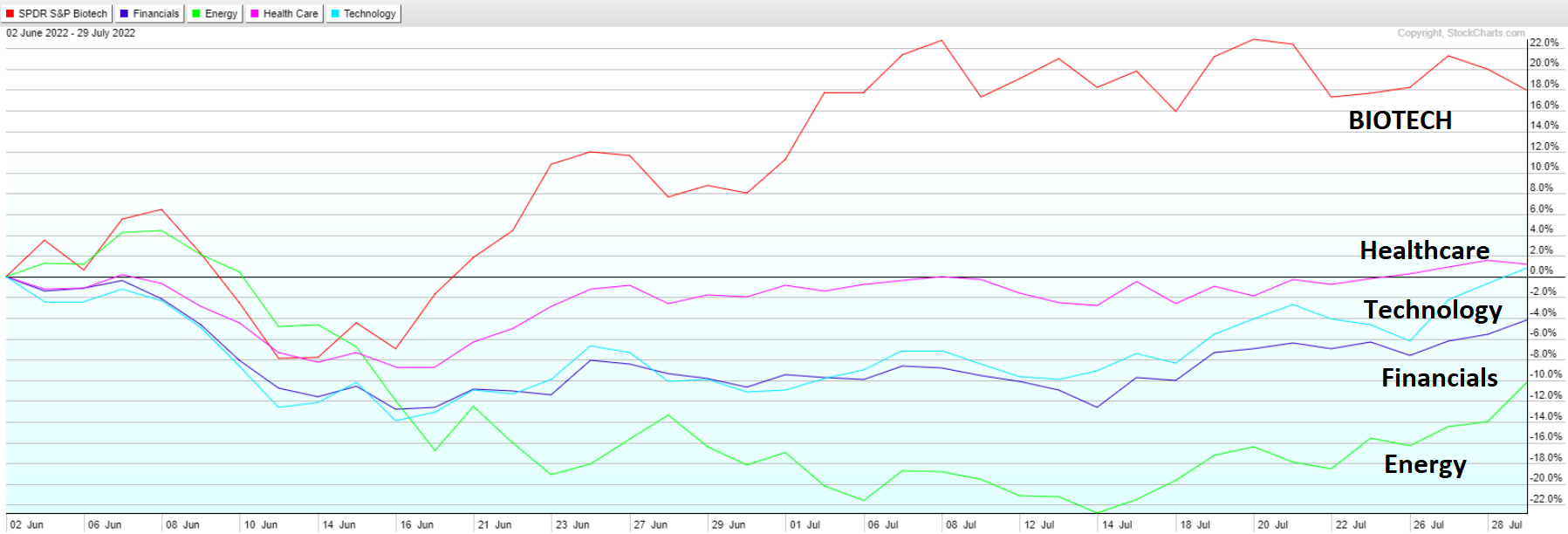

As recession headlines have become more pronounced in the last couple months, it’s worth analyzing how different market sectors have performed relative to one another:

- XBI - Biotechnology sector index

- XLK - Technology sector index

- XLF - Financial sector index

- XLE - Energy Sector index

- XLV - Healthcare sector index

XBI vs. XLK vs. XLF vs. XLE vs. XLK (June/July 2022)

The XBI Biotech ETF is up 18% since the beginning of June. Meanwhile, the next best performing sector is healthcare (+1.22%), followed by technology (+.82%), financials (-4.21%), and energy (-10.23%).

Due to its high failure rate, and capital intensive nature, biotech is often one of the first sectors to get sold off as a market downturn begins. Roughly 90% of early drug development efforts fail, but the other 10% keep the sector going and ultimately produce transformative medicines for patients, and tremendous value for investors. Drug development never grinds to a halt, even in the worst bear market downturns. Furthermore, the global population continues to grow, global wealth continues to increase, and people always have the desire to live longer and with a higher quality of life.

Bear market downturns are a necessary cleansing process that separates the wheat from the chaff while allowing investors to invest in the highest quality companies at attractive valuations. Biotech also tends to be a leading sector, one that not only leads the way lower during downturns, but also tends to turn up first during bull market cycles.

After peaking in February 2021, the XBI Biotech ETF proceeded to decline more than 60%. This makes the 2021-2022 biotech bear market sector downturn the second worst sector decline in the last few decades, surpassed only by the 2000-2002 bear market (-73%). From the ashes of the bear market sprouts tremendous opportunities for investors with the dry powder to take advantage of the abundant opportunities, and the wits to pick winners while managing the inherent volatility of the biotech sector.

XBI bottomed in May, a full month before the broader equity market put in an intermediate term low:

XBI (Daily)

Since forming a powerful double-bottom pattern in May/June the XBI has rallied ~35%, far outpacing the 11% bounce in the Nasdaq-100 and the S&P 500. The strength of the June/July advance in biotech stocks is characteristic of a strong buying impulse, and could be evidence of a transition from a ‘stage 1’ bottom to a ‘stage 2’ uptrend:

It’s also worth noting that the biotech and healthcare sectors have a strong tendency to outperform most other market sectors during economic recessions. Spending on healthcare services and drug research are relatively inelastic, and the wave of baby boomers that are now reaching retirement age will ensure that government spending on healthcare will only continue to trend higher.

Poised for a breakout

In particular, the tiny biotech sub-sector of medical psychedelics experienced an 80%+ sector wide drop from its early 2021 peak. This sub-sector has not only been obliterated, resulting in many companies briefly trading barely above their cash in the bank, but also stands to benefit from a wave of clinical trial results over the next couple of years. The sector will also benefit from a strong drive to promote decriminalization of psychedelic substances and entheogenic plants. This movement to decriminalize or legalize psychedelic substances, such as “magic mushrooms” (psilocybin), is being advanced using the same playbook that helped Americans not only destigmatize but politically embrace cannabis over the past decade. Similar to changing attitudes toward marijuana use, nascent research and personal stories (particularly from military veterans dealing with depression and PTSD) are convincing some lawmakers to rethink longstanding prohibitions on these drugs.

The publicly listed medical psychedelics sector is still in its infancy, and there are still many questions left to be answered as to how these companies will advance their research and eventually monetize their psychedelic drug assets. There are currently over 1,000 ongoing clinical trials for psychedelics indicated against various mental health disorders. One thing is clear: the opportunities for medical psychedelics to disrupt mental health therapy, and many other clinical indications, are enormous and only growing larger.

Medical psychedelics snapshot

- An estimated 26% of Americans ages 18 and older suffer from a diagnosable mental disorder.

- Anxiety disorders affect 25.1% of children between 13 and 18 years old. Research shows that untreated children with anxiety disorders are at higher risk to perform poorly in school, miss out on important social experiences, and engage in substance abuse.

- The U.S. behavioral health market size was US$68.79 billion in 2020, and it is forecast to grow to US$132.4 billion by 2027 (5.3% CAGR).

- Developing safe and effective mental health treatments is not only a huge business market opportunity, but it is also an opportunity to elevate the psychological well-being of humanity and reverse the mental health decline plaguing this post-pandemic world.

- There has been little innovation in the field over the last 70 years. Tricyclics, SSRIs and atypical antidepressants are routinely prescribed even though many patients do not respond positively. All of these medications include a warning label: “risk of suicide”.

- There is a clear need for a complete paradigm shift in the way we treat mental illness.

- Medical psychedelics, including psilocybin (purified from mushrooms), LSD, DMT, MDMA, ibogaine, ketamine, and ayahuasca, are a disruptive and highly effective solution to a growing global mental health crisis.

- Psychedelics may induce neuroplasticity and “rewire” the brain back to a healthy state. Their mechanisms of action target common neurotransmitter pathways, such as serotonin and dopamine, but the extent of their pharmacological action is still being elucidated. However, the ancient ceremonial use of psychedelics to treat mental disorders is a significant de-risking factor for the development of this class of drugs.

- Psychedelics have been used in ancient ceremonies for thousands of years, but were not discovered by Western Medicine until the 1950s. Research in the space was cut short by government programs in the 1960s (MK-Ultra), but the demand for psychedelic medicine has never wavered.

- Recently, there has been a resurgence in clinical interest in these novel treatment modalities, and there are over 50 clinical trials on psilocybin and 90 trials on MDMA underway.

- To date, there is only a single approved medical psychedelic on the market: On March 5, 2019, esketamine (Janssen Pharmaceuticals, a J&J company) became the first approved psychedelic drug by the FDA for the treatment of psychiatric disorders.

- There is an ongoing Phase 3 trial for MDMA as a treatment for PTSD.

- The next series of psychedelic drug approvals will serve as a catalyst for the entire industry. “A rising tide raises all boats.” Multiple industry catalysts are right around the corner.

Final thoughts

Medical Gold is committed to helping investors navigate the biotech sector over the coming years. We have taken a particular interest in the medical psychedelics subsector due to the enormous potential of these drugs to upend the mental health industry and the sector-wide undervaluation. We are focused on identifying the best early-stage opportunities before the market catches on, and appreciates the enormity of opportunities we identified during the first inning of the bull market cycle.

The market bottoming process, and the early stages of a secular bull market, are the times when the opportunity for investors is the greatest. We look forward to applying our proprietary due diligence methodology and decades of combined investment and biotech experience to help you navigate the sometimes confusing and treacherous biotech landscape.

DISCLAIMER:

The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource and biotechnology companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.